Athena: Business Overview

01. Key Investment Highlights

Delhi/NCR India

SECTOR

- K-12 Education Infrastructure

OVERVIEV

- Group of 7 Major K-12 schools with

- 30,000 student capacity

- High Yield Sales and Leaseback with on option to monetize it by REIT listing or secondaries sale

02. Business Overview

- Capitalizer’s target “Athena” is a 2 decades old group of 6 K-12 schools, 72 Junior and preparatory school with collective student capacity exceeding 30,000.

- Over the years, Athena has received accolades, both nationally and internationally for the involvement, commitment and dedication towards fostering innovation and excellence in the education sector.

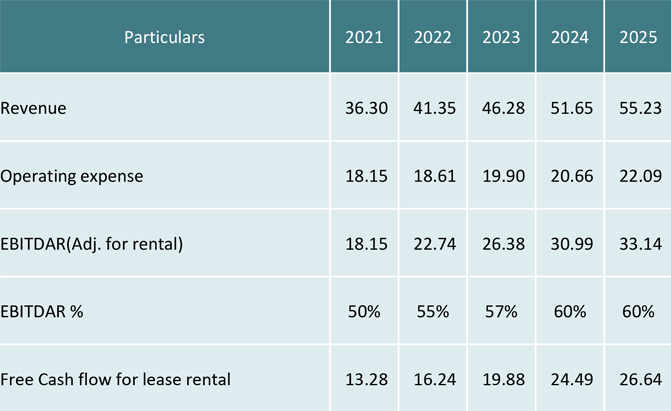

- It is expected to record € 29.11 million in revenue and is expected to grow at 17% CAGR for next five years. It raised debt to the tune of EUR 80 Mn to finance its expansion plan of bringing 4 K-12 schools in 2017-19.

- The business model is very sustainable with high growth potential; Cluster of junior and preparatory schools act as a feeder school to the nearby K-12 school. The strong brand image created over two decades of hard work by its founders will continue to be the most imp. growth driver.

- Management to focus on school’s affairs. Temporary blank spot created in school’s management because of the real estate-based expansion drive, now fixed.

03. Growth Proposition

- Sales and lease back of 1.5 million sq. ft. of real estate.

- Opportunistic investment case; Acquiring real assets at attractive price point when the group is in special situation due to extraordinary and temporary business events.

- Potential to monetize real assets portfolio pooled in CAPITALIZER by going for REIT listing after 3 years.

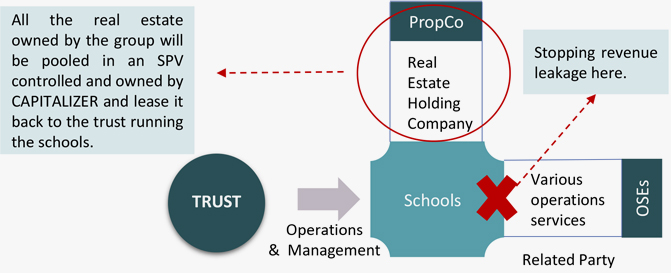

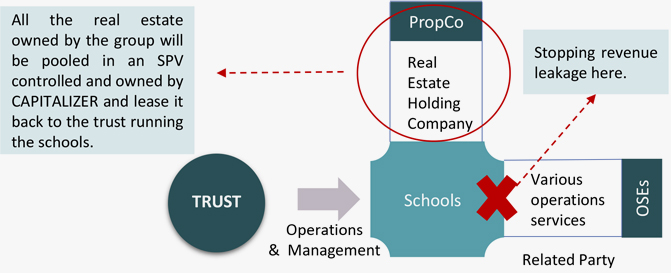

- Potential for turnaround and secondaries sell at higher valuation. Turnaround driven by improvement in operating performance majorly; resolving existing governance issues and protecting revenue leakages.

- Some extraordinary events lead to major but short- lived fall in top line. However, it resulted into cash flow mismatch finally turning book debts bad.

- Considering group’s history and brand value we believe that risk is mispriced, and this sales and leaseback transaction will create value for both Capitalizer as well as for the group.

Athena: Market Outlook

01. Market Outlook

- Capitalizer’s target is a 2 decades old group of 6 K-12 schools, 72 Junior and preparatory school with collective student capacity exceeding 30,000.

- Over the years, Capitalizer has received accolades, both nationally and internationally for the involvement, commitment and dedication towards fostering innovation and excellence in the education sector.

- Capitalizer is expected to record € 29.11 million in revenue and is expected to grow at 17% CAGR for next five years.

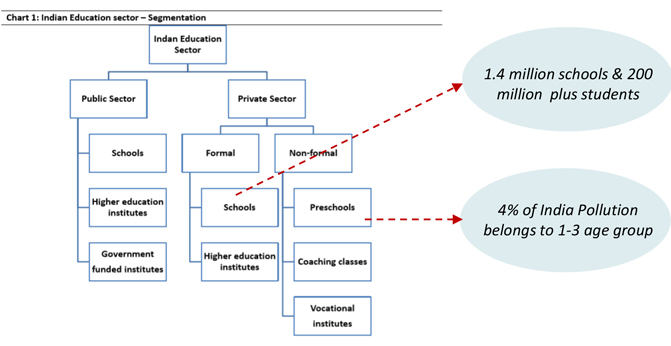

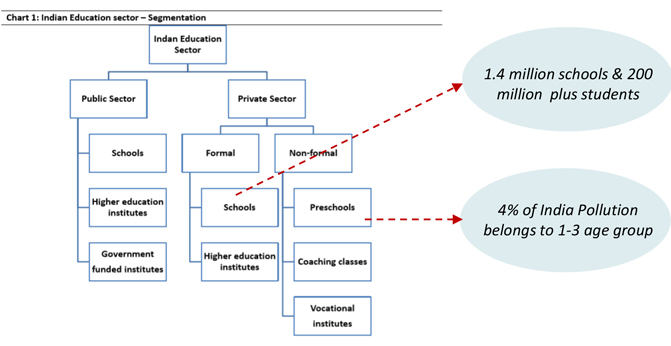

- The private schools managed by the trusts, political, religious charitable organizations are fast scaling up, aggregating 349,412 during FY17 accounting for 23.8% of the total schools in India (Source: DISE).

- Schools are one the very few sectors having high potential for growth and negative working capital.

- The main driver for K-12 schools is the consistent shift towards private schools in India, due to growing awareness of importance of quality education and enhanced affordability.

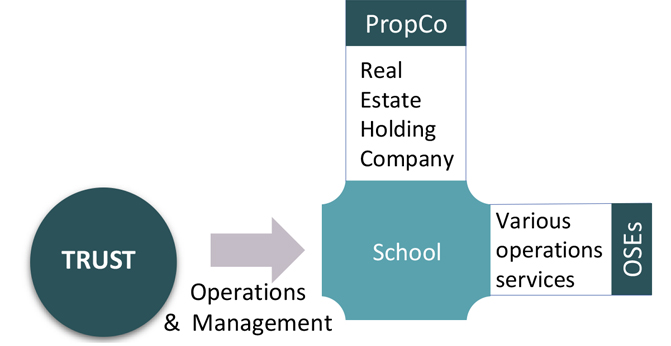

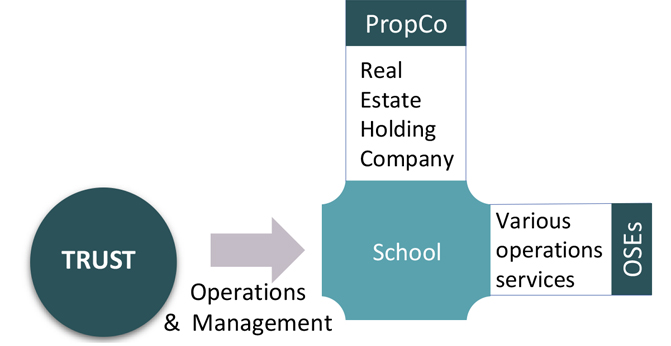

02. Two-three layers of operating structure

With schools being required to run on ‘not for profit’ motive,

the corporates have adopted a two/three-tier structure,

wherein a trust is created to run the school with the company’s

subsidiary / management company being the primary revenue

earner for the services rendered to the school such as

consulting, teacher training etc. The corporates have adopted

a mix of franchisee and owned schools model to scale up their

operations.

Athena: Financial Information

02. Investment Opportunity

Opportunity to acquire and leaseback entire real estate portfolio, thus infusing

much needed cash inflow into the school to be utilised for debt repayment.

This is a special situation case, hence an opportunistic investment where

Capitalizer will own high yield , high quality income producing real assets at

attractive price point.

03. Proposed Structure

Risk Management & Governance

Risk Management & Governance

Risk Management & Governance

Risk Management & Governance- Senior Professional leading investment committee

- Protection against cash flow leakage

- Securing majority on trust’s management committee

- Independent observer from cross functional desks

- Regular Insights from operating partners

- Decision making on portfolio company’s internal control design and internal & statutory auditor’s appointment

- Dedicated desk within CFO function for continuous monitoring and dashboard analysis of portfolio company’s KPIs