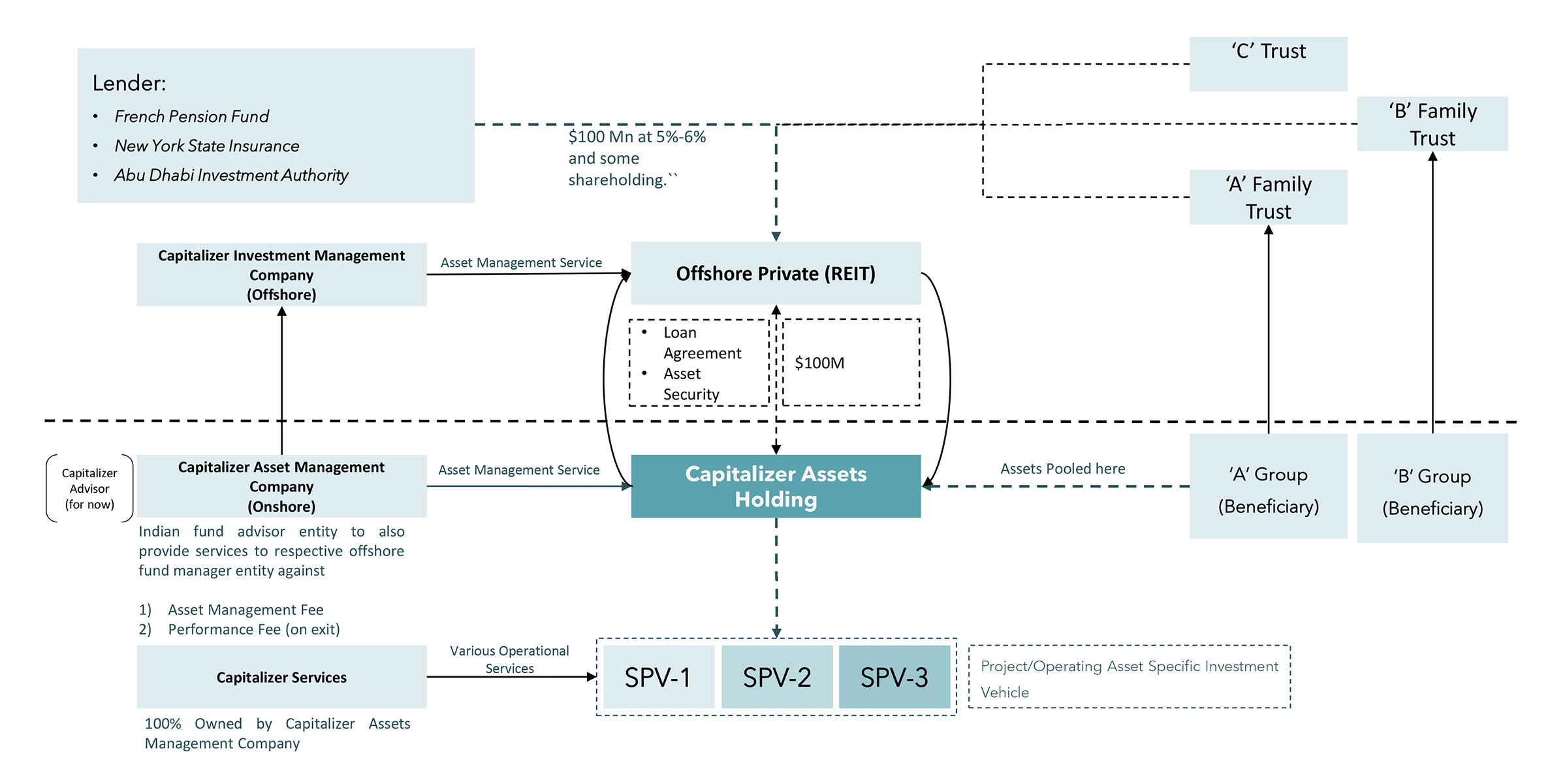

Proposed Operating Structure

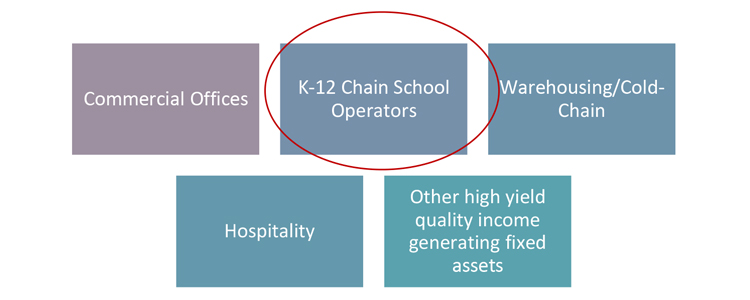

Sales & leaseback of high yield & high-quality education real estate and Infrastructure

Strong Emerging Market Economic Attributes

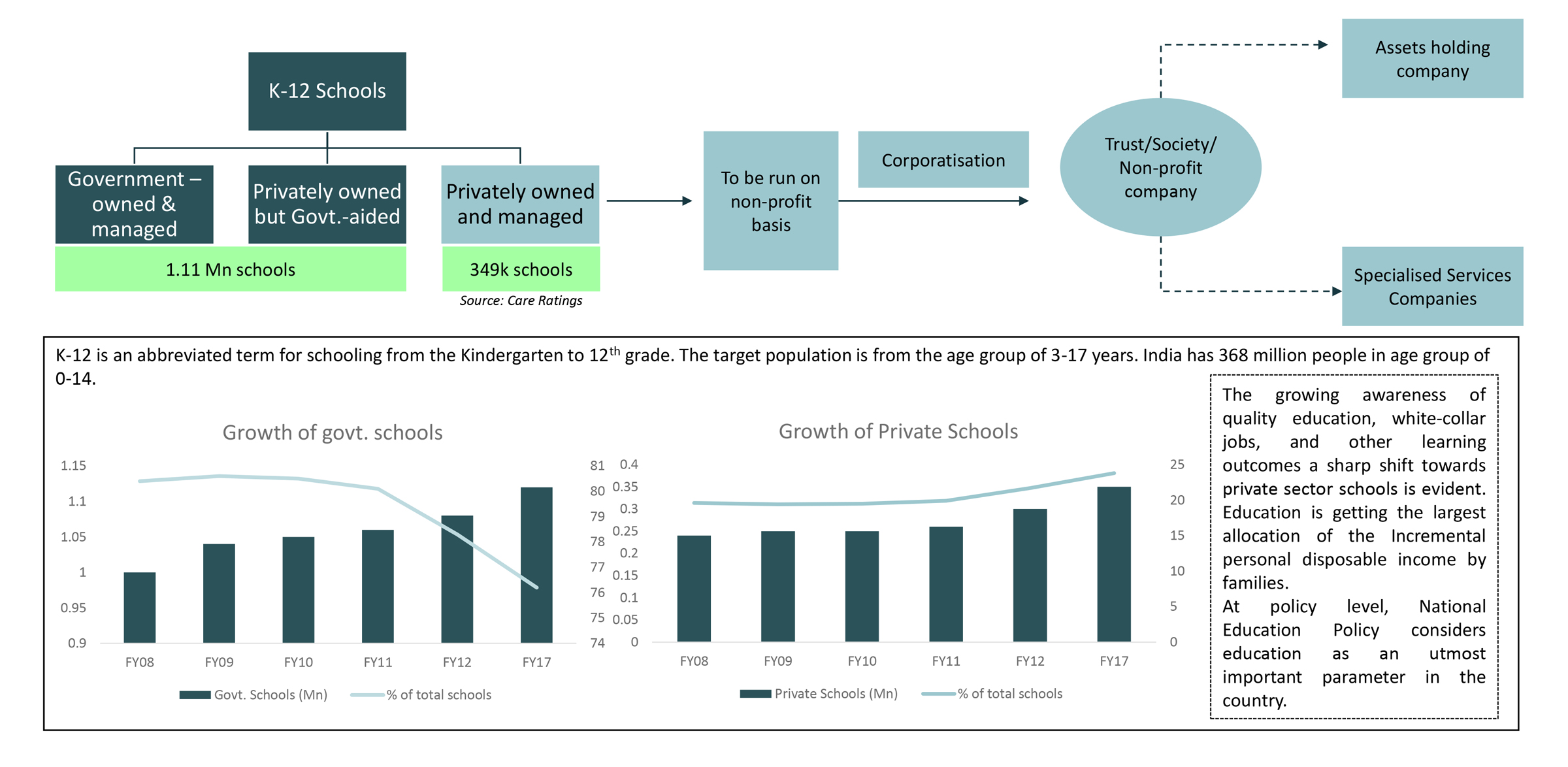

01. Demand greater than supply

There is large and growing demand for high-quality K-12 education. Growing disposable income

and high aspirational values of quality education has resulted in increase in demand from Indian

middle and upper-middle classfor mid-market (€760 –€2500) private education.

India has the largest number of schools (over 1.5 million) and school-goers(over 260 million):

India has the largest number of schools (over 1.5 million) and school-goers(over 260 million):

- 26.6% (male 194 million and female 174 million) is in the age group of 0-14 years

- 17.9% (male 131 million and female 117 million) is in the age group of 15-24 (Source: British Council report- The changing school system in India, 2019)

02. Fee increase higher than inflation

Education is perceived by students/parents as an investment with high returns over a long period

of time, and prices are linked to high end jobs, salaries of which typically grow at a premium to

inflation. In contrast, the largest cost drivers in education typically grow in line with inflation. This

difference leads to healthy margins in mid-price/premium segment schools. In India 6-10% y-o-y

growth is school is sustainable.

03. Long-term revenue visibility

Long-term revenue can be forecasted based on average time a student spends in the

organisation. A higher per student realisation reduces income uncertainty. In K-12 school

segment revenue can be project at single point of time i.e. at the time of enrolment.

04. Barrier to entry high

The main barriers that exist are high capital

requirements, brand name in driving

viability for education service providers,

and government regulations. High upfront

capex requirement and 3-4 years of

gestation period prevents market from

overcrowding.

05. Access to negative working capital

Our education programs require that fees be

paid in advance (quarterly), providing

operators with liquidity to invest with reduced

risk. This “negative working capital” makes

education more operationally and financially

efficient than other sectors.

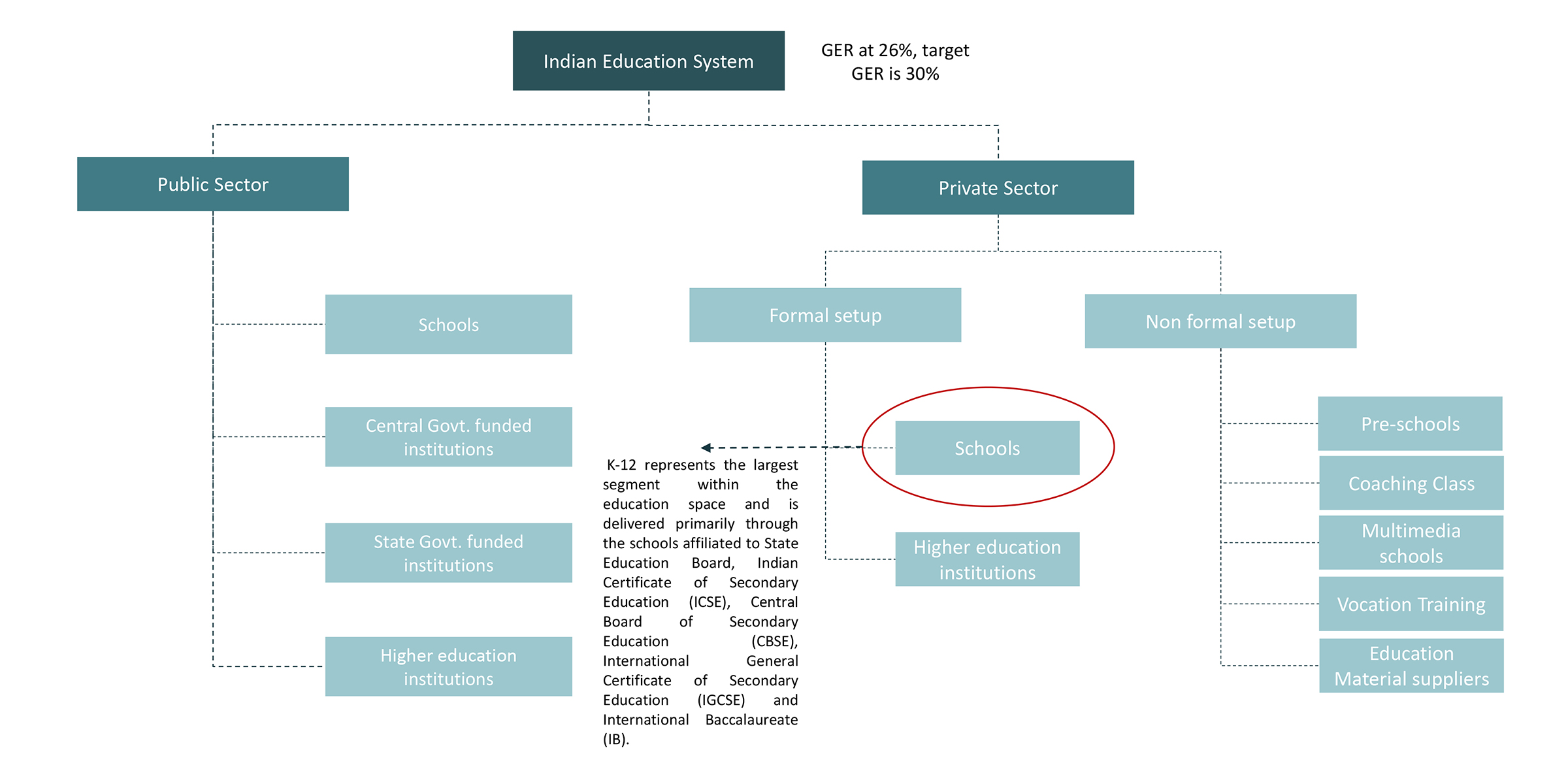

Indian Education System: Structure

K-12 Segment

Capitalizer Edu-Infra Fund

Fund Size : USD 100 Mn

Target Yield (Capital + Interest/Dividend): 13%-17%

Cash Yield: 7%-9%

Capital Appreciation: 6%-8%

Ticket Size - $20M – $50M